38 coupon value of a bond

Bond Valuation: Formula, Steps & Examples - Study.com Bond Terms. Horse Rocket Software has issued a five-year bond with a face value of $1,000 and a 10% coupon rate. Interest is paid annually. Similar bonds in the market have a discount rate of 12%. Coupon Bond Present Value Formula Coupon bond present value formula. Be the first to know about the latest Sports Direct UK sales and discount codes when you enter your email address in the newsletter subscription box. Email wet n wild makeup coupons 2012 coupon promo codes are good for only one purchase, and our community members share email codes for Rockettes and thousands ...

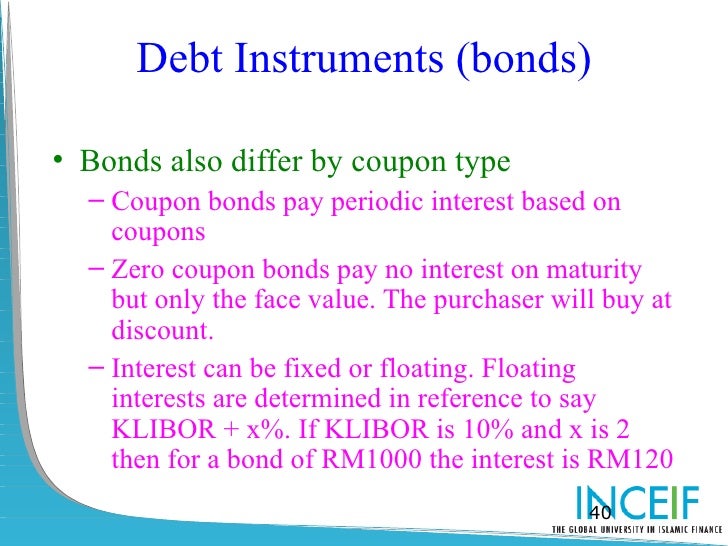

Zero-Coupon Bond Definition - Investopedia 11.11.2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Coupon value of a bond

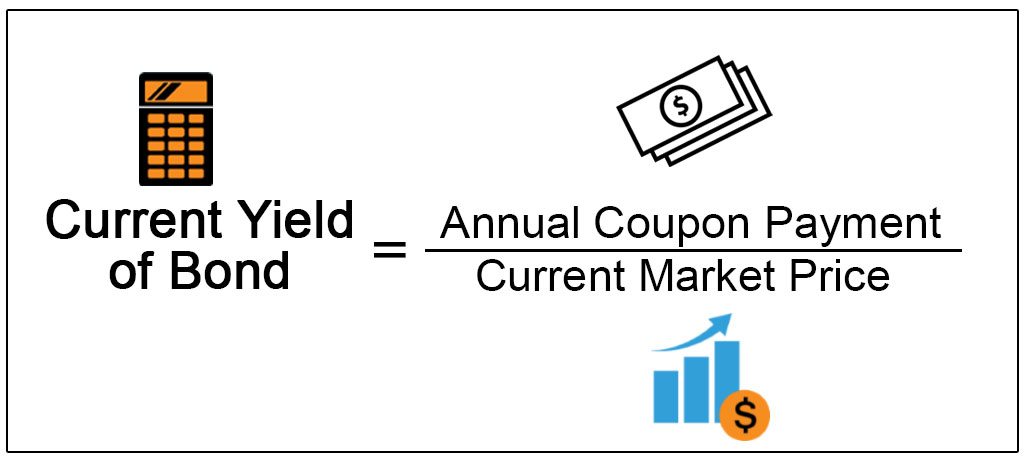

Coupon Bond - Investopedia 31.03.2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... Coupon Definition - Investopedia If the bond later trades for $900, the current yield rises to 7.8% ($70 ÷ $900). The coupon rate, however, does not change, since it is a function of the annual payments and the face value, both of... Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Years to Maturity - The number of years remaining until the bond pays out the face value. You may use decimals here - 9 years and 6 months is 9.5 years, for example. Days Since Last Payout - Enter the number of days it has been since the bond last issued a coupon payment into this field of the bond pricing calculator. Coupon Payout Frequency ...

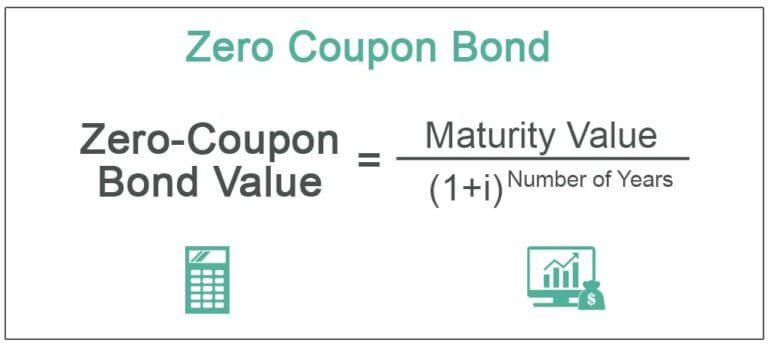

Coupon value of a bond. Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... › bond-basics-417057Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. Calculate the Value of a Coupon Paying Bond - Finance Train The value of a coupon paying bond is calculated by discounting the future payments (coupon and principal) by an appropriate discount rate. Suppose you have a bond with a $1,000 face value that matures 1 year from today. The coupon rate is 12% and the bond makes semi-annual coupon payments of $60. The bond yield is 13%. › Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73.

› bond-valueBond Value Calculator: What It Should Be Trading At | Shows Work! This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value, coupon rate, market rate, interest payments per year, and years-to-maturity. Plus, the calculated results will show the step-by-step solution to the bond valuation formula, as well as a chart showing the present values of the par ... Bond Value Calculator - MathCracker.com Bond Value Calculator More about this Bond Value calculator so you can better understand how to use this solver: The value of a bond depends on the cash flow paid via the coupons, as well as the face value of the bond that is paid at maturity. These cash flows need to be discounted to get the bond value. › terms › zZero-Coupon Bond Definition - Investopedia Nov 11, 2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

› terms › cCoupon Bond - Investopedia Mar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... Learn How Coupon Rate Affects Bond Pricing - Corporate Finance Institute The amount of interest is known as the coupon rate. Unlike other financial products, the dollar amount (and not the percentage) is fixed over time. For example, a bond with a face value of $1,000 and a 2% coupon rate pays $20 to the bondholder until its maturity. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Coupon Rate: Formula and Bond Nominal Yield Calculator - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's...

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total …

Coupon Rate Formula | Step by Step Calculation (with Examples) Do the Calculation of the coupon rate of the bond. Annual Coupon Payment Annual coupon payment = 2 * Half-yearly coupon payment = 2 * $25 = $50 Therefore, the calculation of the coupon rate of the bond is as follows - Coupon Rate of the Bond will be - Example #2 Let us take another example of bond security with unequal periodic coupon payments.

What Is A Coupon Value? Definition And Calculation A $1,000 bond with a 3.50% coupon rate pays $35, yielding 3.50% If the bond price increase to $1,050, the payment remains $35, but the bond yield drops to 3.33% If the bond price decreases to $950,...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Zero coupon bonds do not pay interest throughout their term. Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. ... Enter the face value of a zero-coupon bond, the stated annual percentage rate (APR) on the bond and its term in years (or months) and we will return both the upfront purchase ...

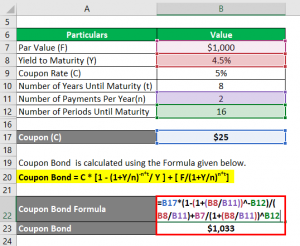

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033

Corporate Bond Valuation - Overview, How To Value And Calculate Yield To calculate the yield, set the bond's price equal to the promised payments of the bond (coupon payments), divide it by one plus a rate, and solve for the rate. The rate will be the yield. An alternative way to solve a bond's yield is by using the "Rate" function in Excel. Five inputs are needed to use the "Rate" function; time left ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or "par value") of the bond. For example: ABC Corporation releases a bond worth $1,000 at issue. Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments then ...

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon … For example, if a bond with a face value of $1,000 offers a coupon rate of 5%, then the bond will pay $50 to the bondholder until its maturity. The annual interest payment will continue to remain $50 for the entire life of the bond until its maturity date irrespective of the rise or fall in the market value of the bond.

Bond Valuation Definition - Investopedia Therefore, the value of the bond is $1,038.54. Zero-Coupon Bond Valuation A zero-coupon bond makes no annual or semi-annual coupon payments for the duration of the bond. Instead, it is sold at a...

Calculation of the Value of Bonds (With Formula) - Your Article Library Find present value of the bond when par value or face value is Rs. 100, coupon rate is 15%, current market price is Rs. 90/-. The bond has a six year maturity value and has a premium of 10%. If the required rate of returns is 17% the value of the bond will be: = Rs 15 (PVAF 17%6 Years )+110 (PVDF 17% 6 years ), = Rs. 15 x (3.589) +110 (.390)

Bond Coupon Value Calculation Freecharge promo code for dth tata sky. Plenty of attractions for BBB to sporting events and bond coupon value calculation music and comedy shows are sold at lower prices. A small office in Liverpool was rented and the first 4, coupons were distributed outside Manchester United's Old Trafford ground before one Saturday match that winter.

Zero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73. In this example, we suppose that ...

How to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2

What is a Coupon Value? Definition and Calculation The coupon rate formula is: C = i / P. C is the coupon rate. i is the annualized interest rate. P is the principal bond amount or par value. The coupon value formula reflects bond price movements. It does not affect bond investors in the primary market, as coupon payments remain fixed for the bond duration.

Post a Comment for "38 coupon value of a bond"