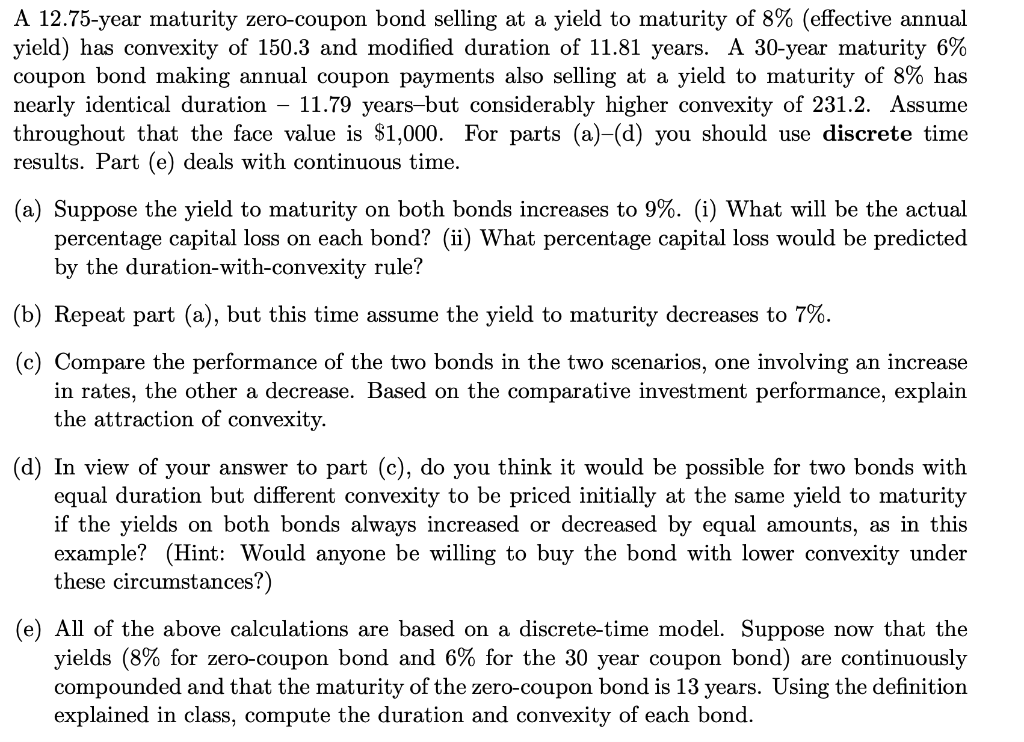

39 zero coupon bonds definition

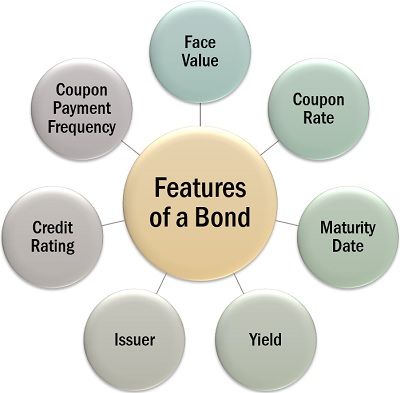

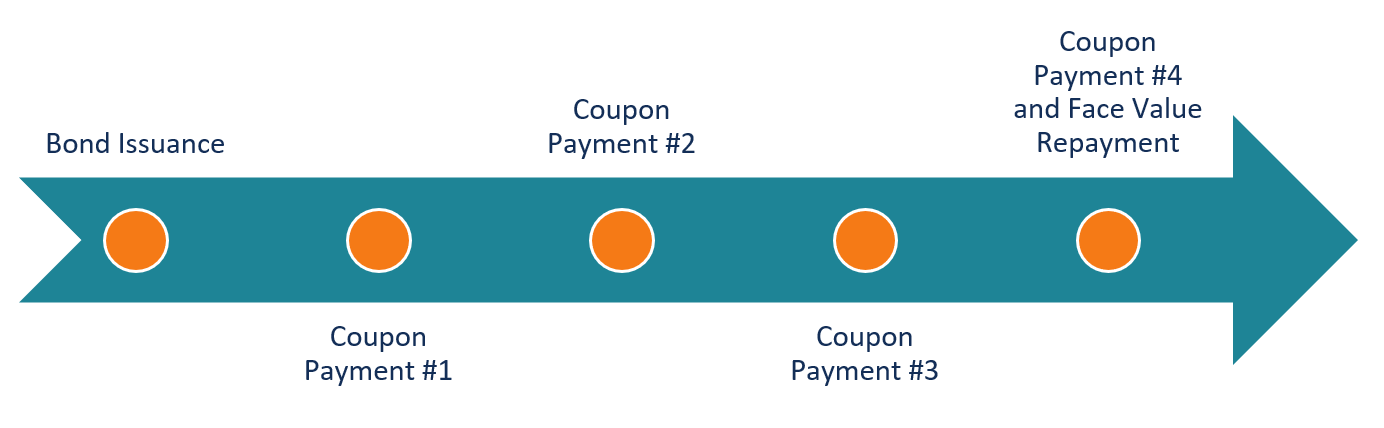

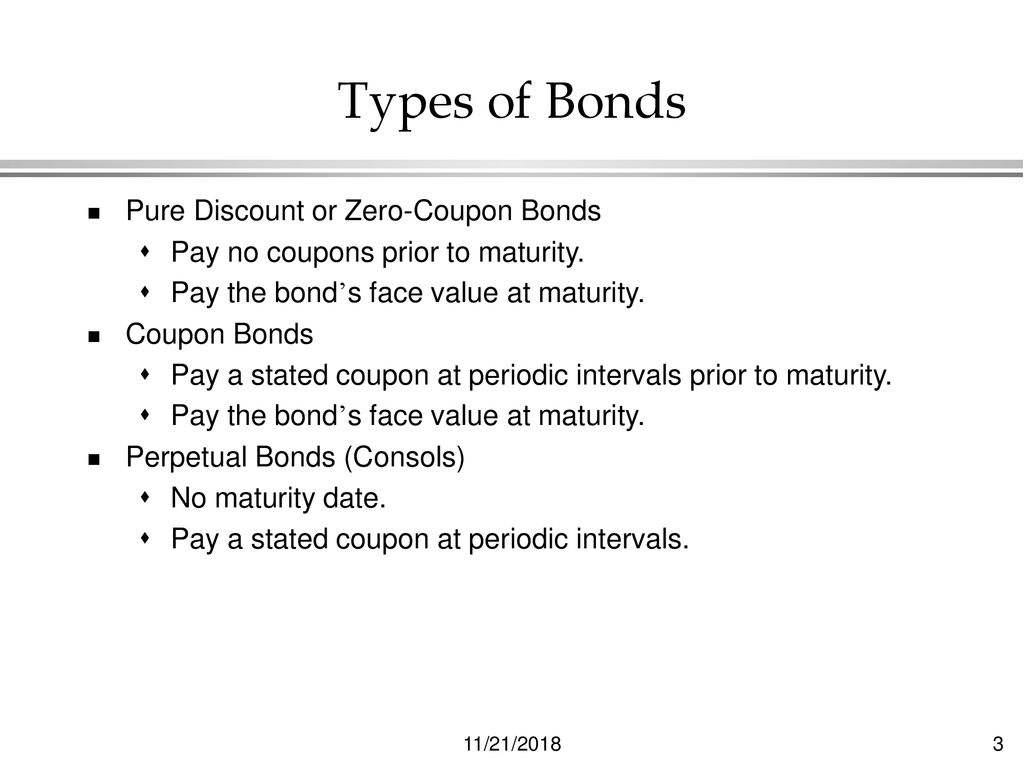

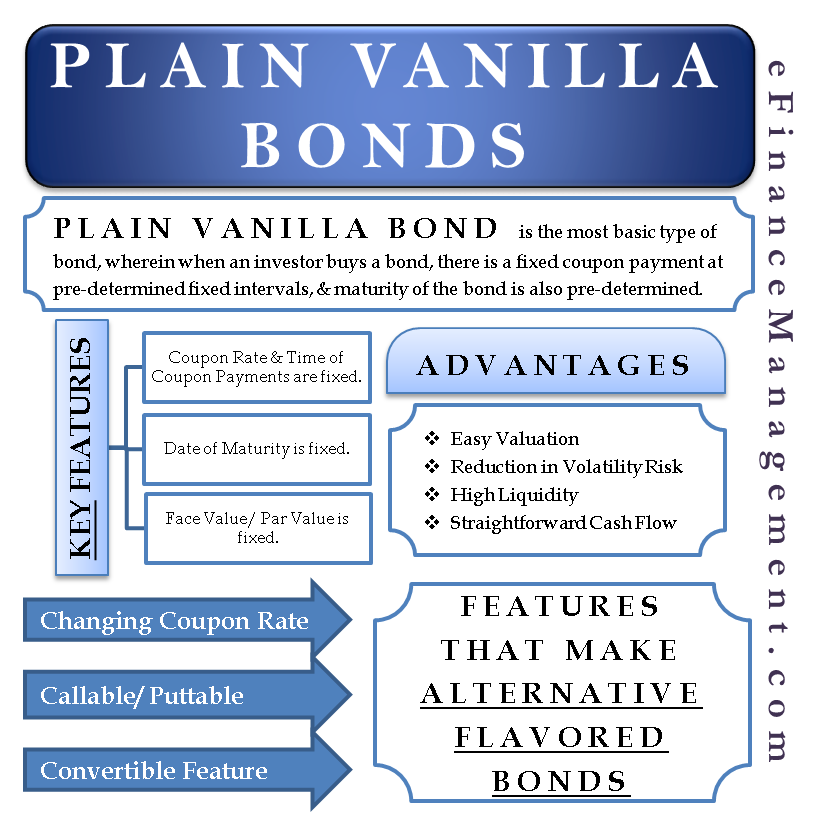

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, … How to Calculate Yield to Maturity of a Zero-Coupon Bond 10.10.2022 · Zero-coupon bonds often mature in ten years or more, so they can be long-term investments.The lack of current income provided by zero-coupon bonds discourages some investors.

› advisor › investingBond Definition: What Are Bonds? – Forbes Advisor Aug 24, 2021 · Zero-Coupon Bonds: As their name suggests, zero-coupon bonds do not make periodic interest payments. Instead, investors buy zero-coupon bonds at a discount to their face value and are repaid the ...

Zero coupon bonds definition

Zero-Coupon Bond: Definition, How It Works, and How To … 31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... What are Zero-coupon Bonds? Zero-coupon bonds, also known as discount bonds, are debt securities that investors obtain at steep discounts on the face value of the bond. This type of bond does not pay any interest during its lifetime. Rather, zero-coupon bonds release the returns at maturity in the form of a lump sum, which is the full face value of the bond. › terms › zZero-Coupon Bond: Definition, How It Works, and How To Calculate May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

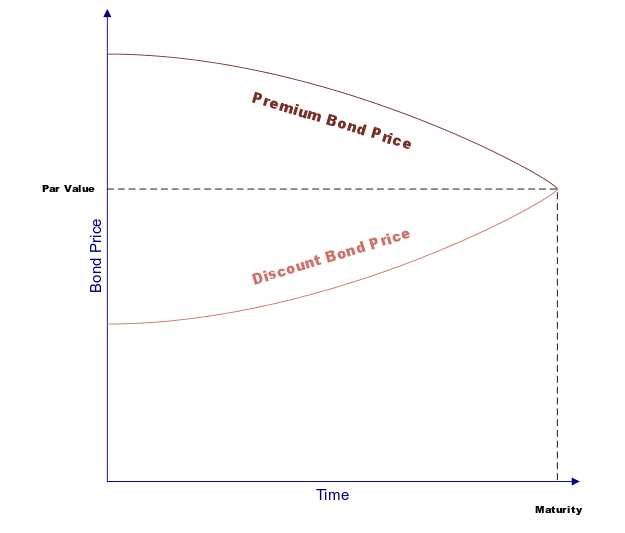

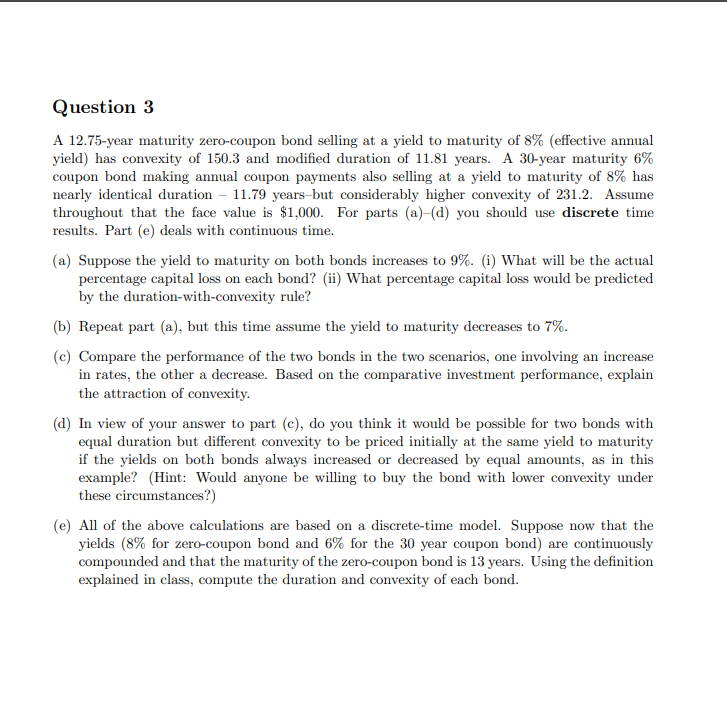

Zero coupon bonds definition. Zero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments. That creates a supply of new … Advantages and Risks of Zero Coupon Treasury Bonds 31.01.2022 · Zero coupon bonds are bonds that do not make any interest payments until maturity, you won't put a single penny of interest in your pocket for two decades. Zero-Coupon Bonds: Characteristics and Calculation - Wall Street Prep Zero-coupon bonds are debt obligations structured without any required interest payments (i.e. "coupons") during the lending period, as implied by the name. Instead, the difference between the face value and price of the bond could be thought of as the interest earned. Zero Coupon Bonds - definition of Zero Coupon Bonds by The Free Dictionary Zero Coupon Bonds synonyms, Zero Coupon Bonds pronunciation, Zero Coupon Bonds translation, English dictionary definition of Zero Coupon Bonds. Noun 1. zero-coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the...

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying... › articles › bonds4 Basic Things to Know About Bonds - Investopedia Oct 24, 2022 · Eric Fontinelle, CPA, is an accounting and finance leader with expertise in startups and nonprofits. He has written on Wall Street fraud, investment banking, and things bond investors should know ... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Zero Coupon Bonds financial definition of Zero Coupon Bonds A bond that provides no periodic interest payments to its owner. A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value.

How Do Zero Coupon Bonds Work? - SmartAsset Zero coupon bonds can be issued by f inancial institutions, c orporations, and f ederal agencies or municipalities. Some of those bonds are initially issued as zero coupon bonds. Others become zero coupon bonds only after a financial institution strips them of their coupons and repackages them. And you still pay taxes on the money you earn from ... home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data What is a Zero-Coupon Bond? Definition and Meaning A zero-coupon bond, also known as a discount bond, is a type of bond that is purchased at a lower price than its face value. The face value is repaid when the bond reaches maturity. Bonds are kinds of debts or IOUs that corporations and governments sell and investors buy. What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder.

Zero-coupon bond | definition of zero-coupon bond by Medical dictionary zero [ze´ro] 1. the absence of all quantity or magnitude; naught. 2. the point on a thermometer scale at which the graduations begin. The zero of the Celsius (centigrade) scale is the ice point; on the Fahrenheit scale it is 32 degrees below the ice point. absolute zero the lowest possible temperature, designated 0 on the Kelvin or Rankine scale; the ...

en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia Zero-coupon bonds are those that pay no coupons and thus have a coupon rate of 0%. Such bonds make only one payment: the payment of the face value on the maturity date. Normally, to compensate the bondholder for the time value of money, the

What Is a Zero-Coupon Bond? Definition, Advantages, Risks What is a zero-coupon bond? Typically, bondholders make a profit on their investment through regular interest payments, made annually or semi-annually, known as "coupon payments." But as...

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are …

Zero Coupon Bonds Explained (With Examples) - Fervent The only thing they do pay is the Par (aka "face value") when the bond matures. Put differently, a zero coupon bond is a bond that doesn't pay any interest. Instead, it only pays a lump-sum payment at the end of the bond's life. That is, at its maturity or expiration date; i.e., the date when the bond matures or expires.

Zero-coupon bonds - definition of Zero-coupon bonds by The Free Dictionary Zero-coupon bonds synonyms, Zero-coupon bonds pronunciation, Zero-coupon bonds translation, English dictionary definition of Zero-coupon bonds. Noun 1. zero-coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the...

en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments.

Involve zero-coupon bonds. A zero-coupon bond is a bond that is sold now at a discount and will pay its face value at the time when it matures; no interest payments are made. A zero-coupon bond can be ...

Bond Definition: What Are Bonds? – Forbes Advisor 24.08.2021 · Zero-Coupon Bonds: As their name suggests, zero-coupon bonds do not make periodic interest payments. Instead, investors buy zero-coupon bonds at a discount to their face value and are repaid the ...

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero-Coupon Bonds - Accounting Hub Definition. A zero-coupon bond is a debt instrument and it pays no periodic interest. This bond is traded at a deep discount to its face value. US treasury bills are a prime example of zero-coupon bonds. These bonds are also called discount bonds. These bonds can be issued with zero interest from the beginning.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww What is Zero Coupon Bond? Zero Coupon Bond, also known as the discount bond, is purchased at a discounted price and does not pay any coupons or periodic interests to the fundholders. Money invested in Zero Coupon Bond does not generate a regular interest during the tenure.

What are Bonds? | Definition & Types | Beginner's Guide 02.09.2022 · For example, U.S. Treasury bills are zero-coupon bonds. Convertible Bonds. Convertible bonds pay fixed-income interest payments but can also be converted into shares of the issuing company’s stock. The conversion from the bond to stock happens at specific times during the bond’s life and is usually at the bondholder’s discretion. It is a ...

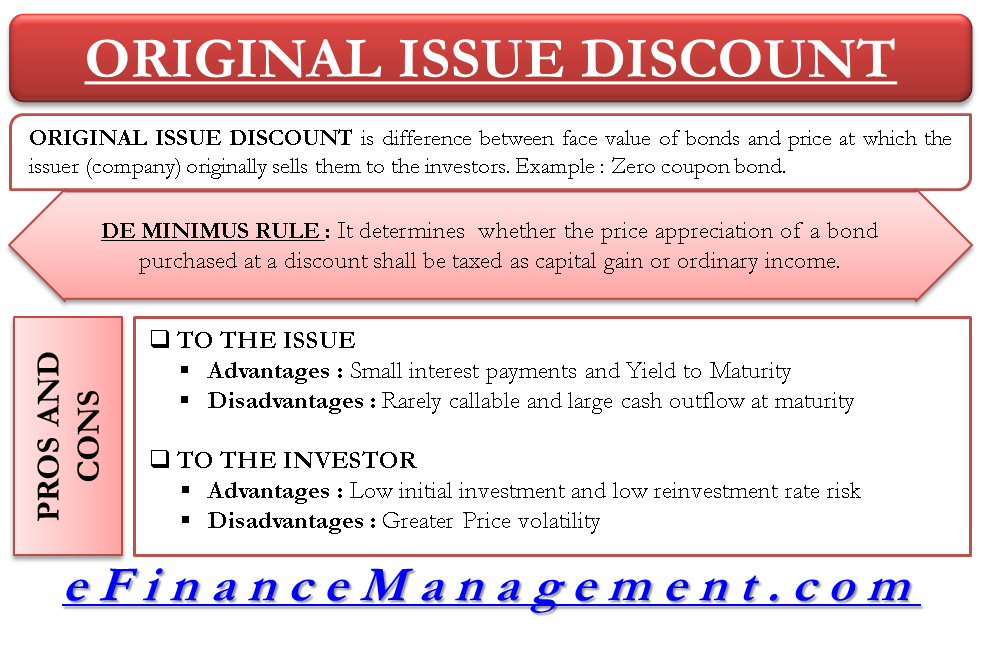

Publication 550 (2021), Investment Income and Expenses Zero coupon bonds are one example of these instruments. The OID accrual rules generally do not apply to short-term obligations (those with a fixed maturity date of 1 year or less from date of issue). See Discount on Short-Term Obligations, later. For information about the sale of a debt instrument with OID, see Original issue discount (OID) on debt instruments, later. De minimis …

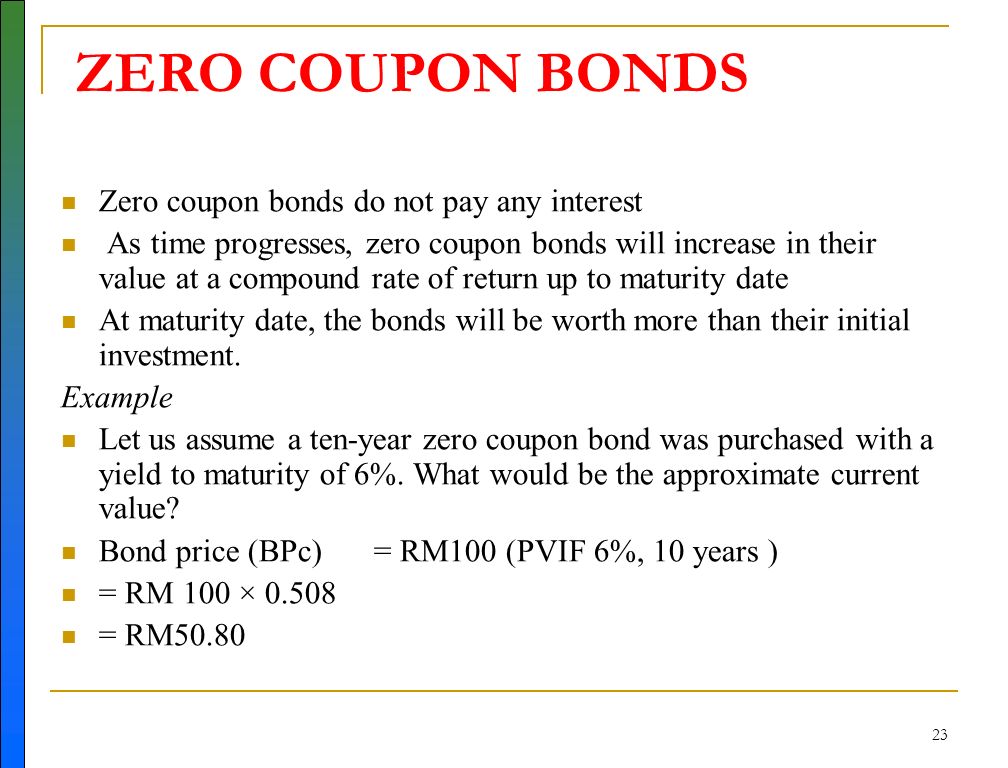

Zero Coupon Bond | FXCM Markets For example, a zero coupon bond with a face value of US$1,000 due in 20 years will be offered at a price of US$200. The difference between the US$200 offering price and the eventual US$1,000 maturity value is the accumulated interest. By contrast, a traditional US$1,000 bond with a 3% coupon is offered at US$1,000, and the investor receives ...

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date.

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Zero-coupon bond financial definition of Zero-coupon bond A bond that provides no periodic interest payments to its owner. A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value.

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

Zero Coupon Bond | Definition, Formula & Examples - Study.com A zero-coupon bond, which is also referred to as "an accrual bond", is a debt security that does not provide investors with periodic payments or periodic interests. Instead, this type of...

Coupon Bond Vs. Zero Coupon Bond: What's the Difference? 31.08.2020 · Zero-Coupon Bonds and Taxes . Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of ...

Zero Coupon Bond: Definition, Features & Formula A zero-coupon bond is a debt asset that trades at a big discount and earns money when redeemed for its full face value at maturity but does not pay interest. A zero-coupon bond is also known as an accrual bond or a discount bond.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself.

› terms › zZero-Coupon Bond: Definition, How It Works, and How To Calculate May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

What are Zero-coupon Bonds? Zero-coupon bonds, also known as discount bonds, are debt securities that investors obtain at steep discounts on the face value of the bond. This type of bond does not pay any interest during its lifetime. Rather, zero-coupon bonds release the returns at maturity in the form of a lump sum, which is the full face value of the bond.

Zero-Coupon Bond: Definition, How It Works, and How To … 31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "39 zero coupon bonds definition"