44 what is a coupon payment on a bond

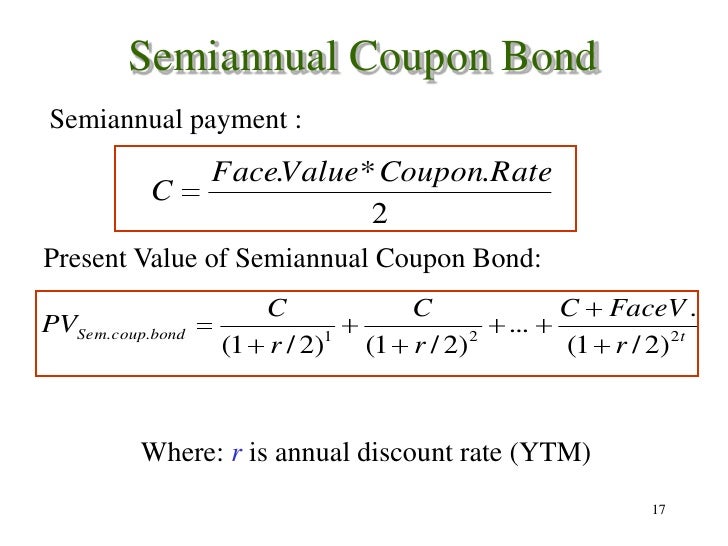

› Calculate-a-Coupon-PaymentHow to Calculate a Coupon Payment: 7 Steps (with Pictures) Aug 02, 2020 · Use the current yield to calculate the annual coupon payment. This only works if your broker provided you with the current yield of the bond. To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). Basics Of Bonds - Maturity, Coupons And Yield A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually.

Bond Yield Rate vs. Coupon Rate: What's the Difference? The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its entire maturity. Prevailing interest rates may rise or...

What is a coupon payment on a bond

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing All types of bonds pay interest to the bondholder. The amount of interest is known as the coupon rate. Unlike other financial products, the dollar amount (and not the percentage) is fixed over time. For example, a bond with a face value of $1,000 and a 2% coupon rate pays $20 to the bondholder until its maturity. › terms › cCoupon Bond - Investopedia Mar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ...

What is a coupon payment on a bond. SriLankan Airlines misses coupon on dollar bond Sovereign's moratorium on all its external debt obligations is also an event of default under the bond terms. SriLankan Airlines has missed a $25m coupon payment on its $175m 7% 2024 bonds, the ... Bond Price Calculator | Formula | Chart A coupon is the interest payment of a bond. Typically, it is distributed annually or semi-annually depending on the bond. It is normally calculated as the product of the coupon rate and the face value of the bond. What is the YTM? YTM stands for the yield to maturity of a bond. Deferred Coupon Bonds | Definition, How it works? Types, Advantages The interest or the coupons on the bond are accumulated over the deferred period mentioned in the bond indenture. For example, you invest INR 10,000 in a five-year deferred bond which pays 8% annually as a coupon. After one year, you will not receive INR 800 as the interest on the bond. Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

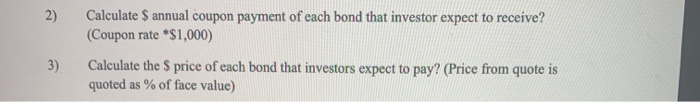

Bond Basics: Issue Size and Date, Maturity Value, Coupon The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. › zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. › terms › cCoupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

› coupon-paymentWhat is a Coupon Payment? - Definition | Meaning | Example Definition: A coupon payment is the annual interest payment paid to a bondholder by the bond issuer until the debt instrument matures.In other words, there payments are the periodic payments of interest to the bondholders. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon rate for bonds is the interest bond issuer pays on the face value of the bond. In other words, it is the periodic interest that the issuer of the bond pays the bond buyer. The couponrate of a bond is computed on the face value of the bond. And not on the market price or the issue price. What Is a Coupon Payment? - Smart Capital Mind A coupon payment is a payment made to the holder of a bond for the interest that bond accrues while it is maturing. This is typically made as a semi-annual payment, so only half of the interest owed on the bond is paid at a time.

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jan 12, 2022 · annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual ...

Difference Between Coupon Rate and Interest Rate A coupon rate is a fixed payment of the bond, and the maturity period is issued by the holder at the initial stage of issuing the bond. It varies according to the bondholders of the bond—for instance, a 5-year bond period. ... Firstly, it is the zero-coupon bonds. They don't have any coupon payment for the bondholder to pay for. Also, it is ...

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Another security that has a unique coupon structure is step-up bonds. These are bonds that have a coupon rate that increases over time. For example, a 5-year step-up bond of the par value of USD 100.00 may have a coupon rate of 5% for the first 3 years and 7% for the last two years. Thus the coupon payment looks as follows -

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Russia in historic default as Ukraine sanctions cut off payments The payments in question are $100 million in interest on two bonds, one denominated in U.S. dollars and another in euros , that Russia was due to pay on May 27. The payments had a grace period of ...

xplaind.com › 945823Coupon Payment | Definition, Formula, Calculator & Example Apr 27, 2019 · A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments. In fixed-coupon payments, the coupon rate ...

Taiwan holders of Russian bonds say haven't received payments: Sources Russia was due to make $100 million in coupon payments on two eurobonds on May 27 — $29 million on a euro-denominated 2036 bond and $71 million on a dollar-denominated 2026 bond.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Russia denies defaulting on $100mn bond coupon payment By Ben Aris in Berlin June 28, 2022. Russia denied that it had defaulted on a $100mn bond payment, saying that the money had been sent to bond holders, in dollars, in May but it was not the Kremlin's fault if the cash was not distributed to bondholders, the Ministry of Finance said on June 27. With a ban on allowing Russia to make ...

Coupon bond definition — AccountingTools A coupon bond has interest coupons that the bond holder sends to the issuing entity or its paying agent on the dates when interest payments are due. Interest payments are then made to the submitting entity. The interest coupons are normally due on a semi-annual basis. A coupon bond is unregistered, so the issuing entity has an obligation to pay interest and principal to whomever holds the bond.

Zero Coupon Bond - Explained - The Business Professor, LLC A bond is a debt instrument issued by the government or by a company. It promises to make routine payments (coupon payments) to the holder. A zero-coupon bond, as the name implies, does not pay a coupon (interest). So, why would people buy a zero-coupon bond? Basically, the bond is sold at a significant discount from its face value.

How Callable Bonds Work - SmartAsset The coupon payment on a bond is the coupon rate times par value, which is the stated face value of the bond. During the bond's lifetime, its issuer pays the coupon payment to the investor in the bond on a typically semi-annual basis. Some bonds have what's termed a call provision, and these are what's known as callable bonds. By ...

WHAT IS COUPON RATE OF A BOND - The Fixed Income COUPON RATE OF A BOND. A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. A point to note is that not all bonds attract coupon payments.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, bond issuers (governments and corporations) reward bondholders (investors) with interest payments called "coupons" over the course of a bond's term before returning the principal amount,...

Understanding Treasury Bond Interest Rates | Bankrate The semiannual coupon payments are half that, or $6.25 per $1,000. If you have a TreasuryDirect.gov account and use it to buy and hold U.S. Treasury securities, the coupon interest payments are...

› terms › cCoupon Bond - Investopedia Mar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing All types of bonds pay interest to the bondholder. The amount of interest is known as the coupon rate. Unlike other financial products, the dollar amount (and not the percentage) is fixed over time. For example, a bond with a face value of $1,000 and a 2% coupon rate pays $20 to the bondholder until its maturity.

:max_bytes(150000):strip_icc()/bond_duration-5bfc37fd46e0fb00260e7d1c.jpg)

Post a Comment for "44 what is a coupon payment on a bond"